SA Submission Pro - Individual

DC Software is committed to providing year on year HMRC compliance updates for all our desktop products, but any new features, like ‘MTD for Itsa’, will only be implemented in our new cloud solution. Therefore, we recommend using ‘Submission Pro – Cloud’ rather than our Windows desktop solution wherever possible. More details.

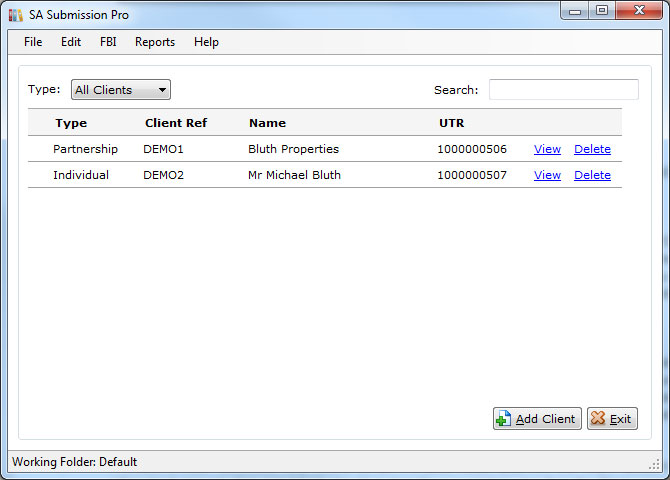

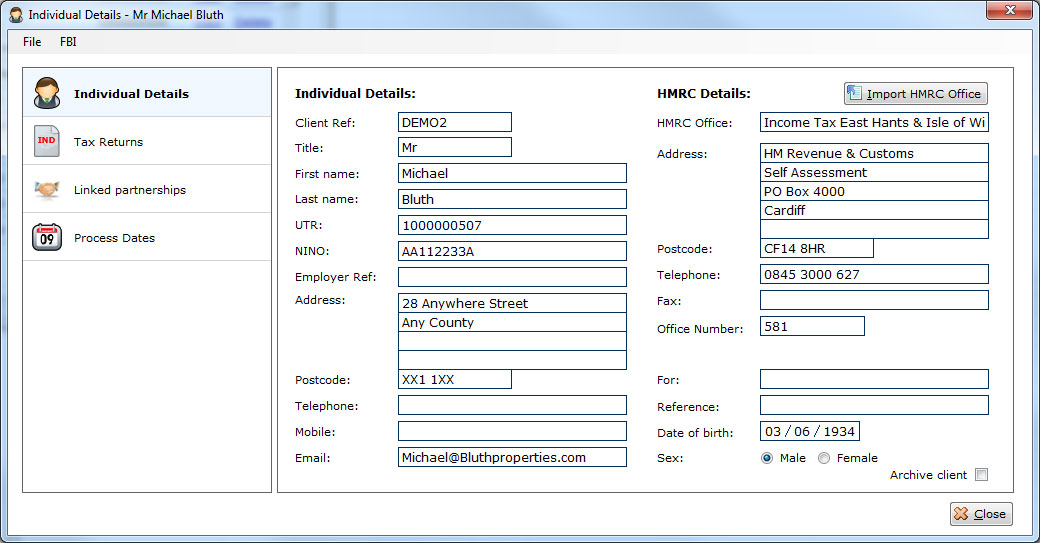

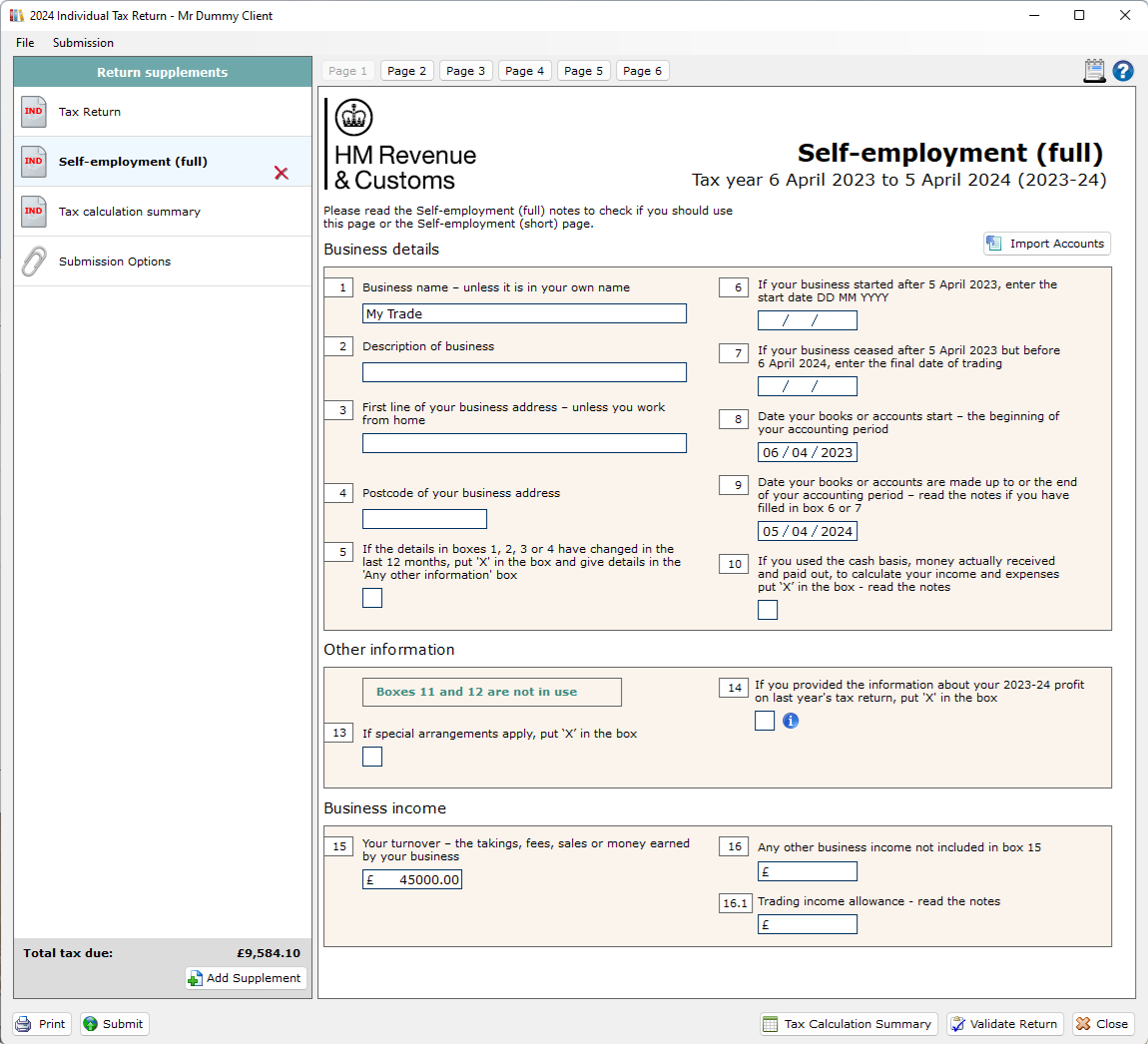

Minimise the time it takes to complete and submit your own or your clients self-assessment Individual Tax Returns by using SA Submission Pro. Data entry that resembles the Tax Return and onscreen validations make SA Submission Pro easy to use for everyone from individuals to experienced Tax practitioners.

For a free evaluation copy click the download button

-

Create and submit the following Self-Assessment - Individual forms

- Tax Return (SA100)

- Additional Information (SA101)

- Employment (SA102)

- Ministers of Religion (SA102M)

- Self-Employment (SA103)

- Lloyd’s Underwriters (SA103L)

- Partnership (SA104)

- UK Property (SA105)

- Foreign (SA106)

- Trusts etc. (SA107)

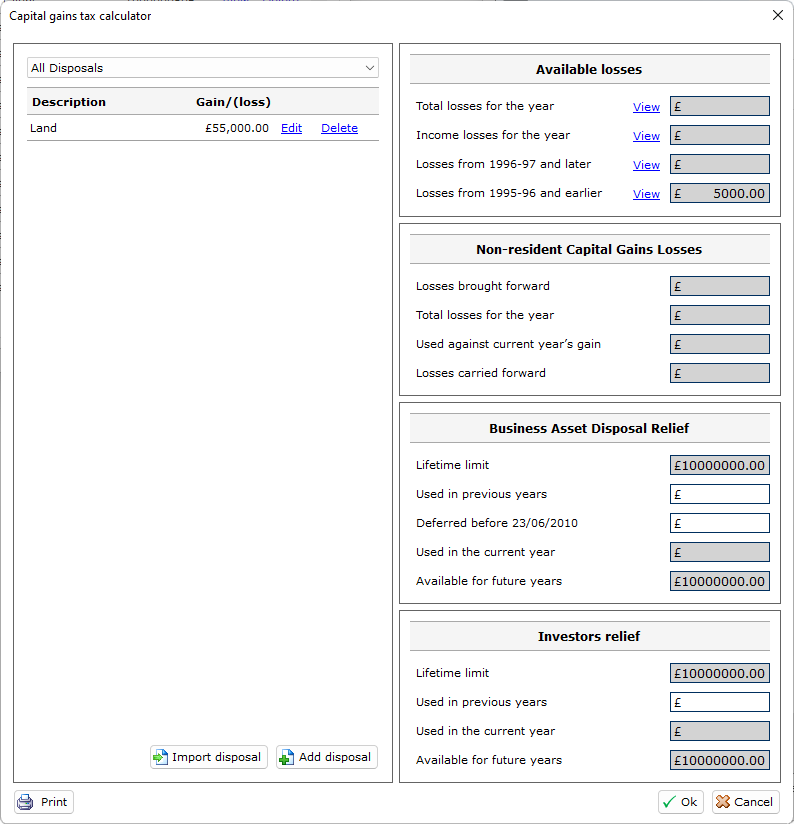

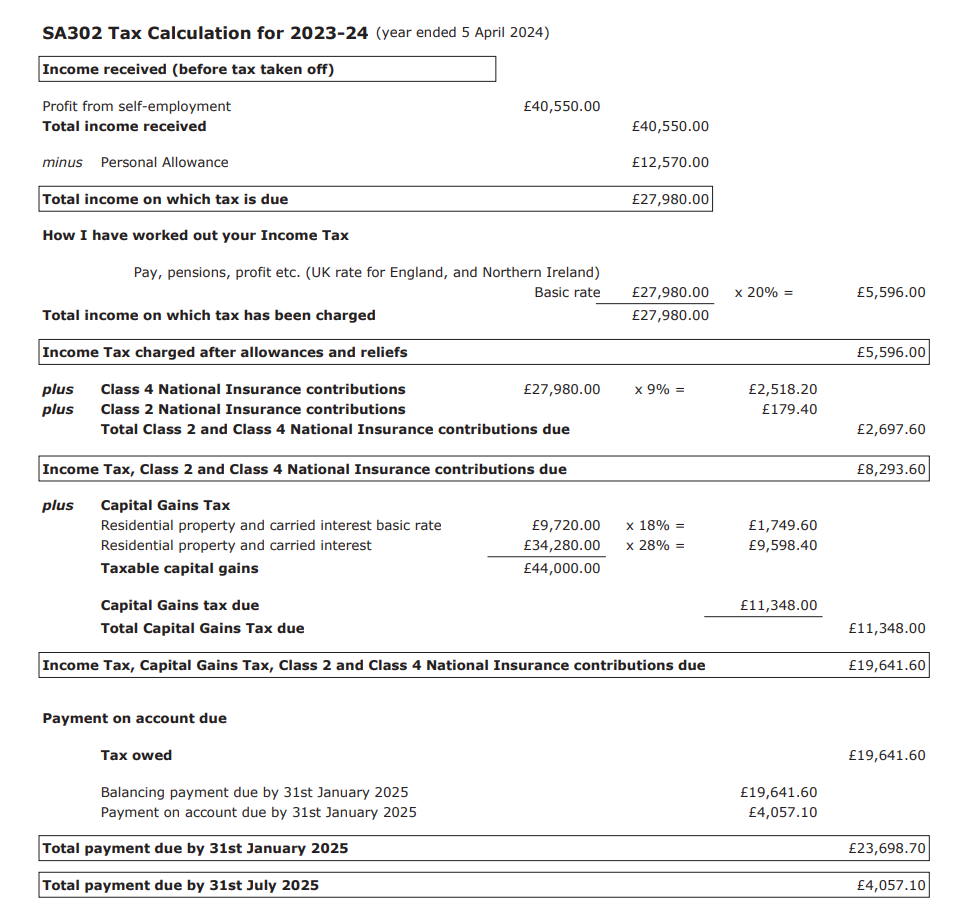

- Capital Gains Summary (SA108)

- Residence, Remittance basis etc. (SA109)

- Automatically complete an individual’s Tax Return by linking it directly to a Partnership return

- Import capital gains and property details from another client to eliminate the need to duplicate data entry

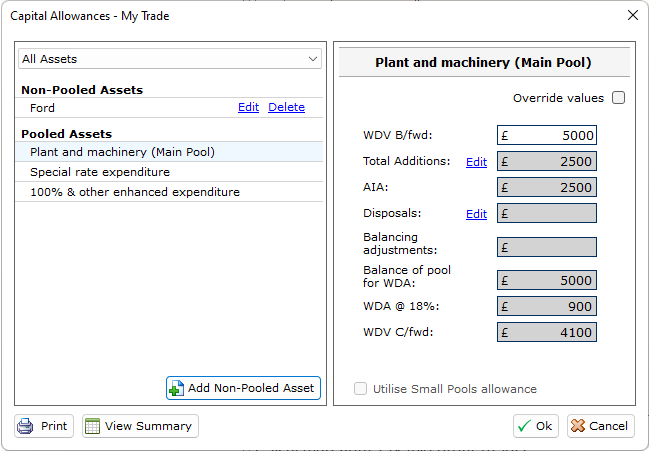

- Backing schedules automatically created for dividends, bank interest and capital allowances, capital gains for easy submission to HMRC

- Roll forward your data for each new tax year

- Print directly onto HMRC forms

- HMRC Notes provided for easy onscreen access

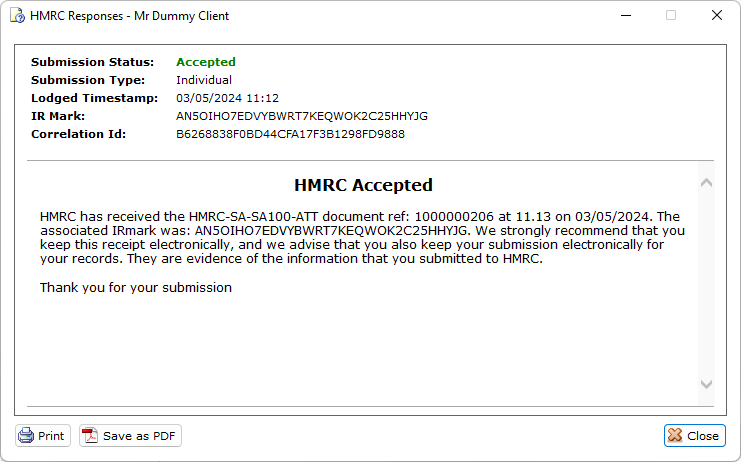

- Submit amended Returns

- Run reports to see the FBI status of your clients

- Add on screen notes to the Tax Return to allow easy tracking of important information

Licence

Price

SA Submission Pro - Individuals: Individual

Activate on 1 PC and submit individual returns for 1 client

£30

SA Submission Pro - Individuals: Limited

Activate on 1 PC and submit individual returns up to 10 clients

£65

SA Submission Pro - Individuals: Unlimited

Activate on 1 PC and submit individual returns for unlimited clients

£140

SA Submission Pro - Individuals: Unlimited Small Business

Activate on 2 PC's and submit individual returns for unlimited clients

£170

SA Submission Pro - Individuals: Unlimited Enterprise

Activate on 5 PC's and submit individual returns for unlimited clients

£220

SA Submission Pro - Individuals: Totally Unlimited

Activate on unlimited PC's and submit individual returns for unlimited clients

£440

*All prices are for a 12 month licence and include VAT

Please ensure you PC meets the minimum system requirements listed below before installing SA Submission Pro.

Operating systems:

Window 7, 8, 9, 10, 11

Window Vista

NOTE: Customers have used SA Submission Pro on Apple Mac environments, but only with the use of Windows emulation software. Although customers have successfully used with relative ease this is something we are unable to support.

Processor:

Intel® 1.3GHz (or faster) or compatible processor

Memory:

512MB of RAM

Hard Disk:

Up to 500 MB of available space may be required

Display:

1024 x 768 high color, 32-bit (Recommended)

Internet Connection:

You will need an internet connection to complete key functionality in SA Submission Pro (like licencing the software and online filing to HMRC)

Other Software:

.Net Framework v4.5

Latest version of Adobe Reader (for printing only)

Internet Explorer 8 or later